Get the Facts: Tax Cuts for Everyone

One of the most ridiculous and distorted attacks against me focuses on my significant involvement and contribution to the 2017 Tax Cuts and Jobs Act. Had it not been for me, our small businesses – which account for approximately 95% of businesses in Wisconsin and throughout America – would not have received any tax relief and would have been put at a significant competitive disadvantage compared to large corporations called C-Corps.

Here’s what happened. Because of legitimate concerns over our growing national debt, Republicans decided to limit the deficit static score for tax reform to $1.5 trillion. Unfortunately, that score only covered cutting taxes for businesses organized as C-Corps to the 20% rate President Trump had campaigned on. C-Corps represent the largest businesses in America but only 5% of all business organizations.

Having owned and operated smaller “pass-through” businesses, I was well aware of how much of a competitive disadvantage smaller businesses would be put at if this disparity wasn’t corrected. In a pass-through business, the income “passes through” to the owners of the company and is taxed at the individual level at progressive individual tax rates. Pass-through businesses include partnerships, Sub-Chapter S Corporations, and LLCs. Most small Main Street businesses choose this form of tax structure.

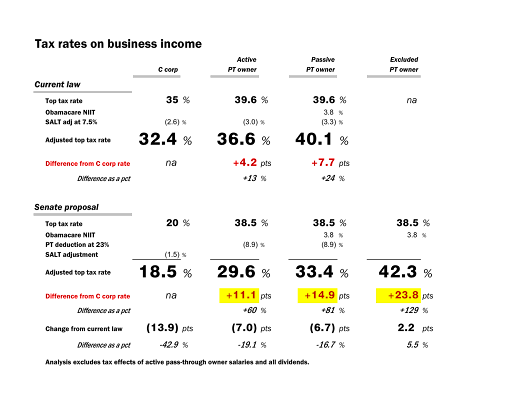

Prior to the 2017 Tax Cuts and Jobs Act, the maximum tax differential between C-Corps and pass-through businesses was 7.7%, with pass-throughs paying the higher rate. Without my intervention, that maximum differential would have increased to a whopping 23.8%. Behind the scenes, I tried my best to convince my colleagues to recognize the harm this would cause and fix this problem, but the $1.5 trillion static score and President Trump’s campaign promise frustrated my efforts.

Here is the chart I developed and used to show my colleagues and the Trump administration’s tax advisors what their tax bill would do to small businesses.

One day, a reporter caught wind of my concerns and asked if I was going to support the tax bill in its current form. I answered honestly by saying no. That was not received well by President Trump’s team, my fellow Republicans, or conservative television and talk radio hosts. But I held my ground, and eventually prevailed by reaching a compromise to increase the 20% C-Corp rate to 21% to accommodate lowering the maximum pass-through rate to 29.6%, an 8.6% maximum differential.

The Left now tries to claim that I somehow carved out a special tax deal for two people who have donated to my campaigns and happen to have large pass-through businesses. That is both absurd and false. My actions were not targeted to benefit a few, but designed to help the many, the roughly 95% of all Wisconsin and U.S. businesses – and the tens of millions of hard working people they employ.

Had it not been for me, Main Street businesses would have been left behind and found it very difficult to compete with the big guys. I’m proud of my efforts and believe that without me, many small businesses would have failed because of the competitive disadvantage, or converted to C-Corp status and thus dramatically reduced the amount of tax revenue tax the federal government would have received.

I hope you will share this explanation that lays out the truth of my efforts with others. With all the false and distorted attacks against me, it’s simply not possible for me to refute them all through paid advertising. The Democrats and liberal groups have spent almost $70 million against me. I am their top target, and they will continue to outspend me, and lie about and distort the truth. In addition to sharing this e-mail with your family and friends, any financial support you are willing to offer would be greatly appreciated. We can’t afford to let the radical left win by taking this Wisconsin U.S. Senate seat. Donate here to prevent that from happening.

Fighting for freedom,

Ron Johnson